¿Cómo Revolucionará el Nuevo Proyecto Hotelero de €150 Millones el Futuro Turístico de Estepona? ¡Explora el impacto del nuevo hotel de lujo

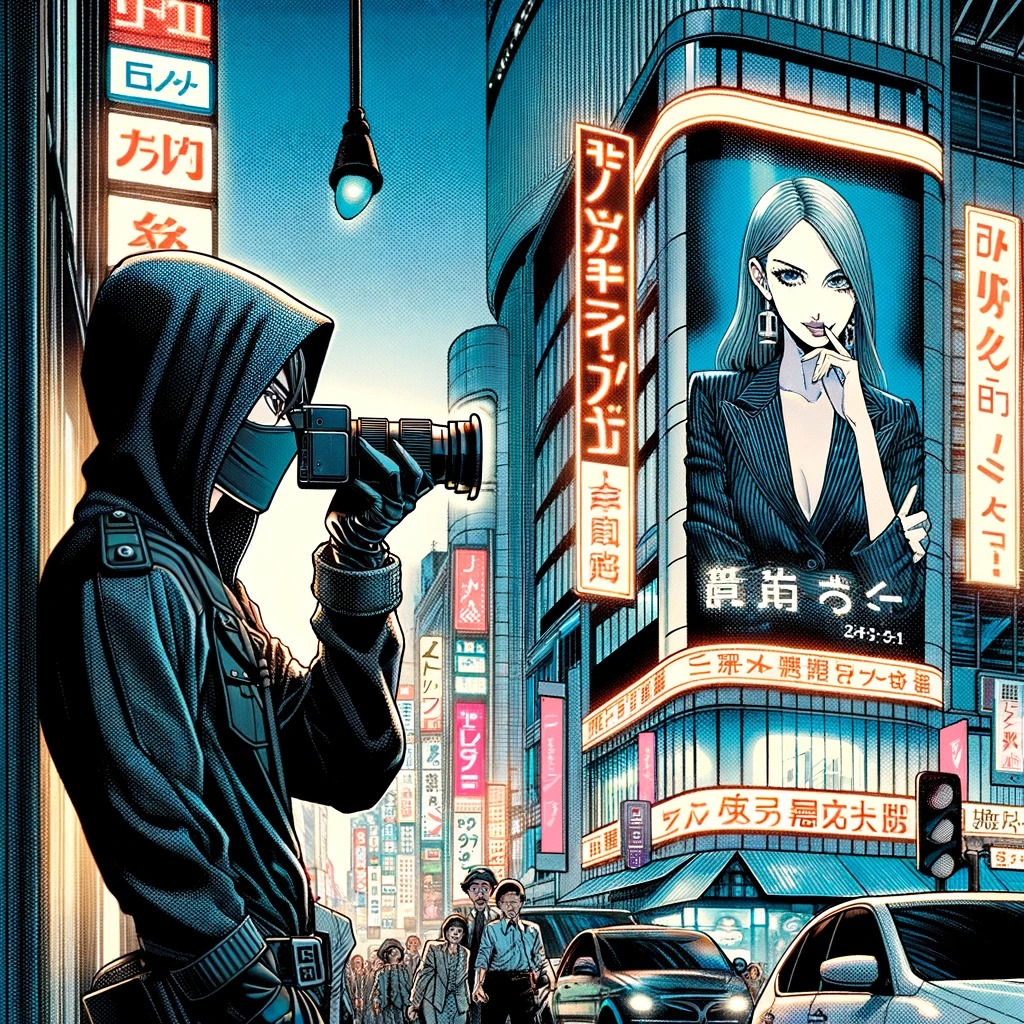

More¿Hay Realmente Espionaje Masivo en España? 🕵️♂️👀🔍 Espionaje en España: Un Análisis Detallado de la Vigilancia a Personas con Relevancia Mediática y

MoreEl Futuro del Tecno-Orientalismo: Perspectivas Galácticas sobre la Fascinación y el Miedo Tecnológico Tecno-Orientalismo en el Futuro: ¿Cómo Impactará Nuestra Visión de

MoreENTREVISTA: Axel Kaiser revela el impacto de Javier Milei en el futuro de América Latina Descubriendo los secretos tras la victoria de

MoreEl Suicidio de Occidente: Un Viaje por la Crisis Educativa con Alicia Delibes 📘✨Crisis Educativa en Occidente: El Suicidio de Occidente por

MoreDONDE APOSTAR HOY. Descubriendo las Apuestas Más Rentables: ¡Gana Dinero Mientras Duermes! 🎰💸 En un universo donde la emoción y el cálculo

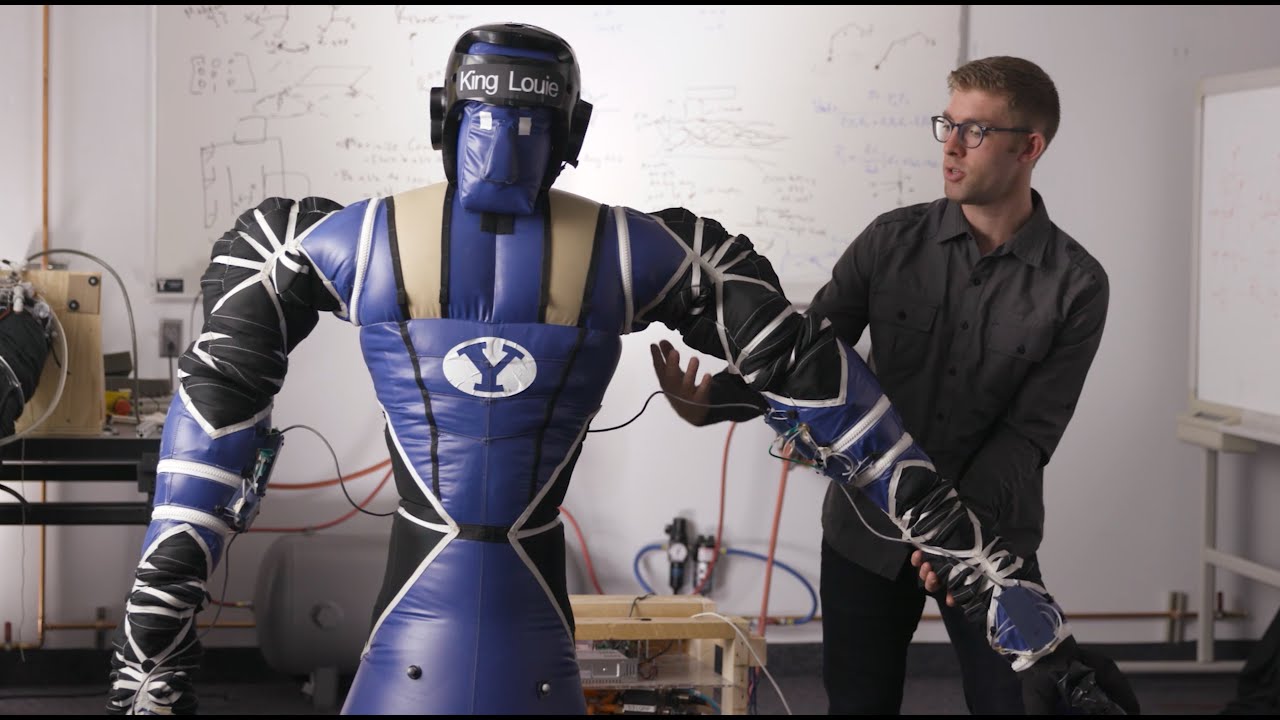

MoreRobots Inflables: La Revolución Futurista en la Investigación Espacial y el Cuidado del Hogar 🤖💨🚀 Robots Inflables: Suavidad y Seguridad en la

MoreENTREVISTA: El Futuro de las Ferrovias Lunares – Inversiones y Proyectos en la Luna ¡Proyecto Espacial Revelado! Ferrovias en la Luna: ¿Ciencia

MoreBMW Vision Neue Klasse X: ¿La Revolución de los Vehículos Deportivos o un Espacio Viviente sobre Ruedas?” 🚗💡 Experiencia de Diseño Holístico

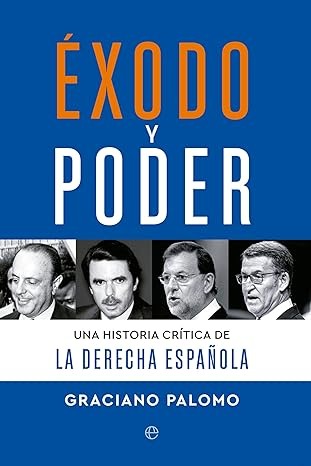

MoreErrores y aciertos del PP a través de los ojos de un veterano de la prensa política Es 2024 y en este

MoreLa NBA planea un salto futurista: ¿Liga Europea en el horizonte? 🏀✈️ La NBA mira hacia Europa: Un futuro de canastas transatlánticas

MoreEl Aérotrain de Francia: Cuando el Futuro del Viaje Voló Hacia el Olvido por el Tren de Alta Velocidad 🚄✈️🇫🇷 El Futuro

MoreAlfa Romeo en el futuro: ¿Exploramos alternativas en un mundo post-apocalíptico? Bajo el amparo de Stellantis, Alfa Romeo se adentra en un

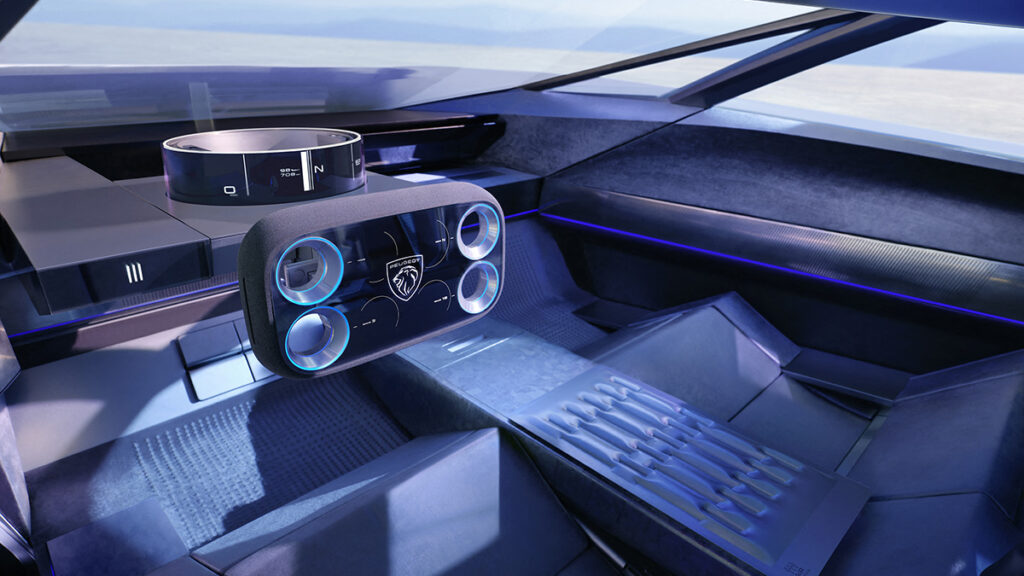

MoreEl Futuro al Volante: Peugeot Transforma la Conducción con su Innovador Hypersquare para 2026 Hypersquare: el Volante Futurista que Veremos en 2026…

MoreDEFENSA DE DERECHOS – Reclamador.es Hace años se ponía de moda el crowdfunding o financiación por participaciones y nos encontramos ya entonces

MoreTendencias y alternativas de casas prefabricadas modernas: ¿Pueden estas cajas mágicas ser tu próximo hogar de ensueño o tu peor pesadilla ecológica?

MoreLa cosmética natural, una tendencia sólida En la búsqueda de un enfoque más natural y saludable para el cuidado del cuerpo y

MoreZaha Hadid Architects: Un Giro Futurista en la Renovación de la Torre Le Schuylkill de Mónaco “Renovando el Pasado, Construyendo el Futuro:

MoreAlternativas retro a Tinder: Tinder es una aplicación de citas popular conocida por su sistema de deslizamiento rápido para encontrar conexiones románticas

More¡Adiós al caos robótico! MIT revoluciona la eficiencia de almacenes con IA. Robótica en almacenes, eficiencia IA, MIT innovación 🤖✨ La implementación

MoreRobot que haga las tareas del hogar: ALOHA, el futuro de la limpieza doméstica Un nuevo robot con IA podría cambiar para

MoreEl Regreso Eléctrico del Renault 5: Revolución Retro-Futurista en el Salón del Automóvil de Ginebra El renacimiento eléctrico de un ícono: el

MoreEn la era digital actual, donde los datos son abundantes y omnipresentes, las empresas están recurriendo cada vez más al HR Analytics

MoreNavegando el Futuro con LG Online: Alternativas Impensables para un Mundo Mejor 🚀🌍 – Explorando las Innovaciones de LG para un Futuro

MoreEl Futuro del Baloncesto Llega a las Canchas: Conoce el Revolucionario Balón Airless Gen1 de Wilson – Balón Airless Gen1 de Wilson:

MoreAlternativas de CRM en la nube para pequeñas empresas ¡Revoluciona tu Pequeña Empresa! 🚀🌐 En el actual entorno empresarial, caracterizado por su

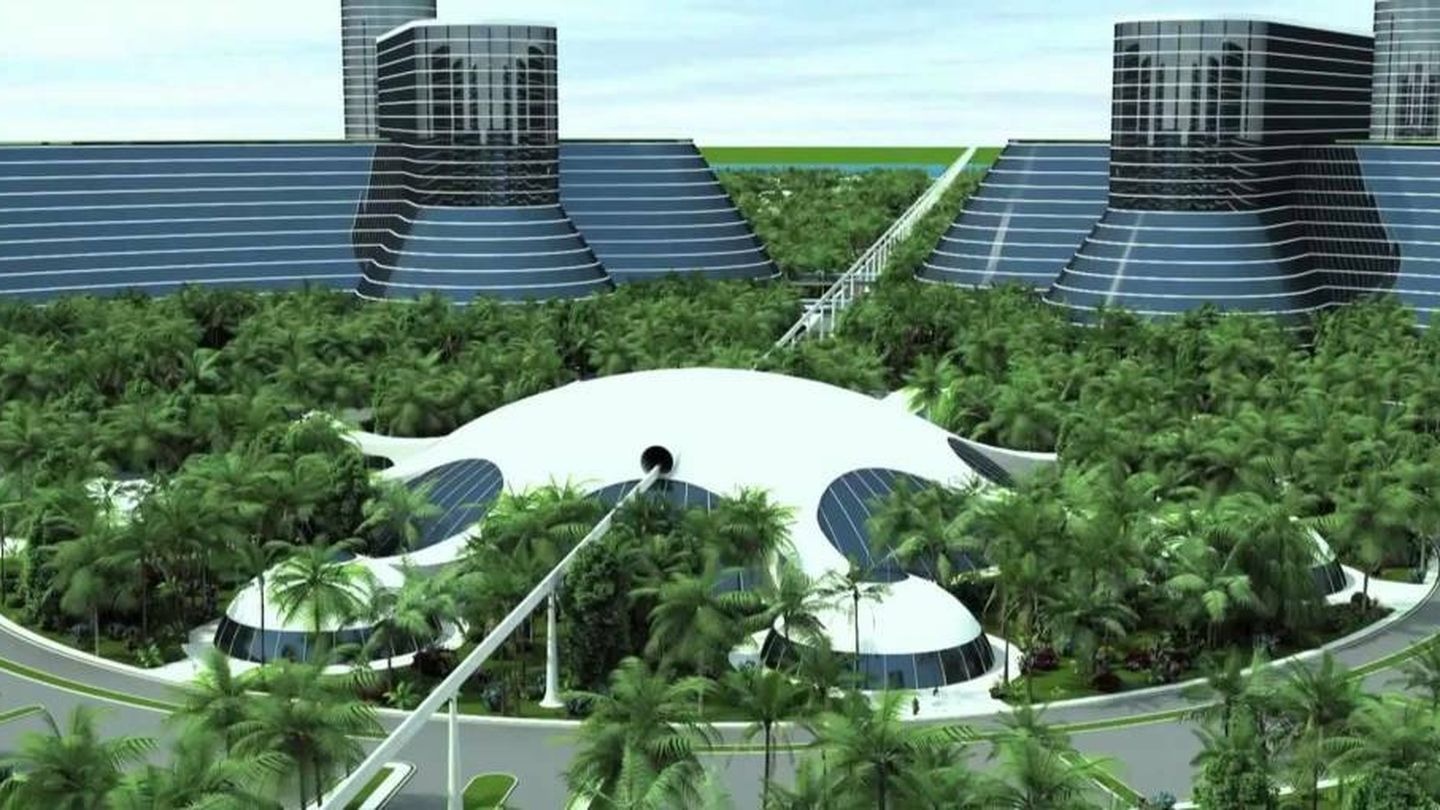

More¡El Futuro según el Proyecto Venus! 🌍✨ ¡Descubre cómo el Proyecto Venus podría remodelar nuestro futuro! 🚀🌱 (ACTUALIZADO 2024). El Proyecto Venus

MoreEstas son todas las energías alternativas y así es su viabilidad económica. Tipos de energías alternativas. En el mundo de hoy, donde

MoreEstrategias futuras para empresas industriales. Nuevas alternativas de servicios para empresas industriales. En la vanguardia de la precisión y la eficiencia dentro

MoreAirbus MAVERIC: Revolucionando la Aviación con el Diseño de Ala Mixta Introducción al Airbus MAVERIC El Airbus MAVERIC representa una audaz incursión

More¡Descubre las Asombrosas Alternativas de Aviones del Futuro Que Revolucionarán el Cielo! 🚀✈️ El horizonte de la aviación está al borde de

MoreAlternativas para defender tus derechos. ¡Defiende tus derechos con estas estrategias innovadoras y efectivas! 🛡️. Las violaciones de los derechos humanos continúan

MoreTELOSA CITY: ¡La Futurista Utopía en el Desierto! 🌆🌞 La ciudad del futuro en el desierto 🏜️✨ Telosa City, un ambicioso proyecto

MoreRevolucionando las Relaciones Públicas: ¡Alternativas Innovadoras para 2024! 🚀🌟 Descubre las Alternativas Más Novedosas para Relaciones Públicas en 2024 📢✨ El mundo

More¿Las luchas de poder y la globalizacion mundial afectan mucho a la vida cotidiana? ¿Está la era de la globalizacion causando un

MoreStalker: Shadow of Chernobyl, Clásico Eterno – Legado y Profundidad. Un Viaje Misterioso en Chernobyl Stalker: Shadow of Chernobyl, la primera entrega

Morelas mejores bicicletas eléctricas del mercado: Buscamos la bicicleta eléctrica alternativa pa siempre… La prioridad para todos debería ser vivir de una

More